Table of Contents

- 1 Why Today Is the Perfect Day to Start a Roth IRA

Why Today Is the Perfect Day to Start a Roth IRA

The Luxury Bandit Money Moment: Make Your Future Self Proud

In a world where rising prices meet shrinking value, it’s more important than ever to prioritize financial wellness. Smart money management is a powerful form of self-care, and here at The Luxury Bandit, we believe financial education should be as routine as skincare or morning coffee.

One powerful and often-overlooked tool in your financial toolkit is the Roth IRA. Whether you’re a seasoned investor or just beginning your wealth-building journey, this type of retirement account offers a tax-advantaged way to invest in your future, and it’s easier to get started than you think.

What Is a Roth IRA and Why Should You Care?

A Roth IRA (Individual Retirement Account) allows you to contribute money you’ve already paid taxes on; like income from your paycheck or side hustle earnings, and invest it for retirement. The game-changer? The growth in this account can be withdrawn tax-free, as long as a few conditions are met.

This means the money your account earns through investments over the years can be yours to enjoy in retirement, without owing a penny in taxes.

Roth IRA Requirements You Need to Know

Before you open an account, make sure you understand these essential rules:

-

Minimum Holding Period: Your account must be open for at least five years before you can access tax-free investment earnings.

-

Age Requirement: You must be 59½ or older to withdraw earnings without penalty.

-

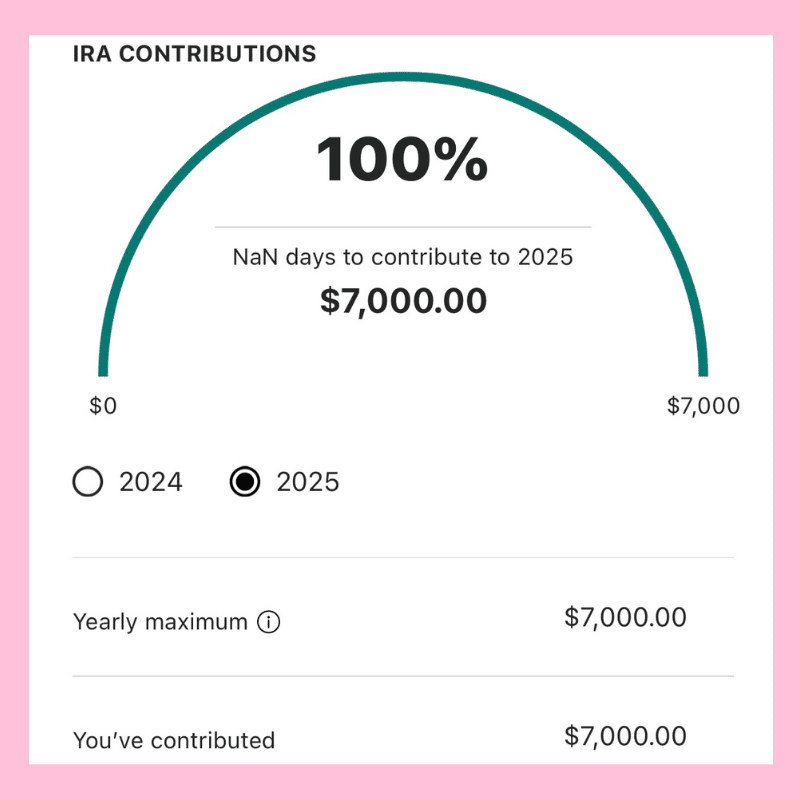

Contribution Limits for 2025:

-

Up to $7,000 annually if you’re under 50

-

Up to $8,000 annually if you’re over 50

-

Contributions can be made at any time throughout the year, but starting early maximizes growth potential.

The Best Investment Strategy? Time

Compound growth works best when paired with time. That’s why I personally make it a goal to max out my Roth IRA at the beginning of each calendar year. By doing so, I allow my investments the maximum time possible to grow, year after year.

If you’re new to investing, don’t stress. Roth IRAs can be easily opened through reputable platforms such as Vanguard, Fidelity, or E*TRADE, all of which offer user-friendly online account setups.

Why This Matters for Your Future

A Roth IRA is more than just a financial account; it’s a future-focused lifestyle choice. It represents freedom, balance, and the ability to maintain your quality of life during retirement. Whether you envision global adventures or quiet moments in your dream home, a Roth IRA supports the luxury lifestyle TLB is known for, without financial stress.

Getting Started Is Easier Than You Think

Here’s your 3-step quick-start to open a Roth IRA:

-

Choose a platform: Vanguard, Fidelity, and E*TRADE are all trusted, beginner-friendly options.

-

Fund your account: Transfer money from your checking or savings.

-

Select your investments: Choose a diversified portfolio, or use automated investment tools to help guide your choices.

Let’s Make Financial Freedom Part of the Conversation

Investing isn’t just for the wealthy—it’s for anyone willing to plan intentionally. A Roth IRA is a strategic, accessible option that aligns with TLB’s mission of luxury through empowerment. Start now, and let your money work for you.

Have questions about Roth IRAs or other smart-money strategies? Drop them in the comments or connect with me directly. We’re building wealth and community, one step at a time.

Suggested Read Next: [5 Effortless Ways to Save More in 2025 Without Changing Your Lifestyle]

Looking to level up your financial game this year? Here’s how to make your money work harder with minimal effort.